Redefining Financial Frontiers: Nucleus Software Celebrates 30 Years with Synapse 2024 in Singapore

2024-11-25

2024-11-25

Nucleus Software Export Ltd

HaiPress

Nucleus Software Export Ltd

HaiPress

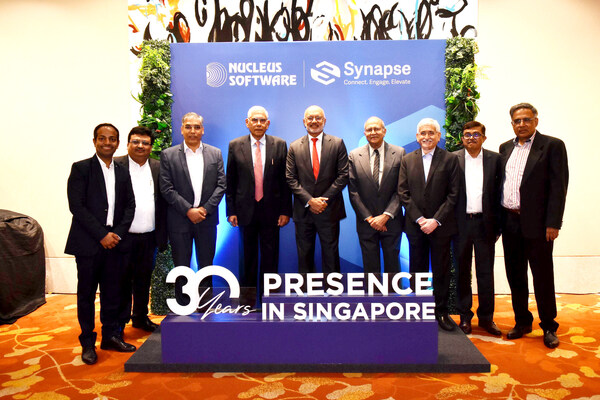

SINGAPORE,Nov. 25,2024 --The thriving India-Singapore partnership in banking and technology reached a new milestone as Nucleus Software celebrated 30 years of transformative innovation at Synapse 2024,held in Singapore. The event underscored the company's role in redefining financial services across Southeast Asia (SEA) and the globe,bringing together leaders in finance and technology to explore a shared vision for the future of banking.

Mr. Vishnu R. Dusad,Co-Founder & Managing Director at Nucleus Software with other key dignitaries at Synapse2024.

Synapse 2024 celebrated 30 years of Nucleus Software's leadership in driving transformative change across Singapore and Southeast Asia's financial ecosystem. The event also shone a spotlight on the Global Finance & Technology Network (GFTN),an initiative supported by the Monetary Authority of Singapore (MAS) to champion responsible technology adoption. The event highlighted the deepening synergies between India and Singapore,driven by their shared commitment to innovation,cross-border collaboration,and financial inclusion. As the financial services sector undergoes rapid evolution with advancements in artificial intelligence,blockchain,and digital banking,these partnerships are setting the stage for a more connected,resilient,and inclusive global ecosystem.

Vishnu R. Dusad,Co-founder and Managing Director of Nucleus Software,reflected on the milestone: "For over 30 years,we've had the privilege of aligning our journey with Singapore's ascent as a global financial powerhouse. Back in 1994,when we chose to go East instead of West,it was a bold and emotional decision—guided by our belief in Singapore as a hub for innovation and collaboration. We saw then what remains true today: Singapore is at the heart of the global financial landscape,a place where new ideas take root,and partnerships thrive."

The event brought together a distinguished array of participants,highlighting the transformative potential of India-Singapore collaboration. Mr. Piyush Gupta,CEO of DBS Group and the Guest of Honor,set the tone for the event with his opening remarks,emphasizing the transformative role of big tech in reimagining scalable,customer-centric financial services in the digital age.

Following his address,key speakers enriched the discussions with their insights. Mr. Sopnendu Mohanty,Chief Fintech Officer at the Monetary Authority of Singapore and Group CEO-Designate of The Global Finance & Technology Network (GFTN),underlined the importance of fostering responsible technology adoption and building inclusive financial ecosystems. Mr. Vinod Rai,globally respected public policy expert,Distinguished Visiting Research Fellow at the National University of Singapore,and former Comptroller and Auditor General of India,shared his perspectives on governance and policy frameworks in financial systems. Mr. S.M. Acharya,Chairman of Nucleus Software and former Defence Secretary of India,offered a visionary outlook on leveraging technology to modernize and secure banking frameworks. Finally,Mr. Pieter Franken,Co-founder and Director of GFTN (Japan),a global FinTech pioneer and deep tech innovator,discussed the future of decentralized finance and its implications for the financial sector.

The event showcased the transformative role of technology in global financial systems,emphasizing innovations that set benchmarks for scalability and inclusivity. Panelists discussed the importance of localized solutions,the challenges of cross-border integration,and leveraging dual business models to optimize capital and foster public participation. The dialogue highlighted the need for common standards,unified frameworks like APIs,and collaborative efforts to accelerate financial inclusion and drive global connectivity in the digital age.

For 30 years,Nucleus Software has consistently introduced advanced lending and banking solutions that support financial institutions' evolving needs in Singapore and South East Asia. Driven by lean development methodologies like Acceptance Test-Driven Development (ATDD) and Continuous Integration/Continuous Delivery (CICD),Nucleus Software continues to push boundaries in efficient,flexible,and secure financial technology.